Open enrollment season – and 2020 – are in the rear-view mirror. As you and your team look toward the next round, it’s an opportune time to ask the question: What’s missing from your benefits strategy?

When you’re competing for talented individuals, it’s particularly important to develop a benefits strategy that keeps up with – or rises above – your own competitors. After all, 69% of employees say having a wider array of benefits would increase loyalty to their employer, according to a survey from Metlife.

These steps can help you figure out what’s missing from your benefits package, and how you can develop a plan that attracts the best talent, adapts to our challenging times – and keeps costs under control.

Step 1: Benchmark your benefits offerings against those of your competitors.

2020 was a challenging year for employers around the world, whether they were managing remote workforces or working to keep in-person employees healthy and safe.

Overall, many large employers responded in similar ways to the health crisis. More than half (59%) increased investment in telemedicine, according to the 2020 Gallagher Benefits Strategy & Benchmarking Survey. Forty-five percent of employers enhanced their overall voluntary benefits, both healthcare and non-healthcare, reflecting an increase of 5 points over the previous year. Taking a look at benchmarking surveys can help you get a sense of where your company’s offerings stand, and where there may be gaps.

Looking for insight into how your specific competitors have shifted their employee benefits strategy? Go undercover as a job seeker and do some sleuthing. Check out job listings from your competitors, and compare the benefits they list against yours – with a grain of salt, of course, if their descriptions are short on details.

Step 2: Evaluate emerging trends.

As you research, it’s also helpful to look at benefit trends. What new programs are just now emerging in popularity, and how can your company get ahead?

It’s no surprise that COVID-19 had a significant impact on employee benefits strategies for 2021. In response to the COVID-19 pandemic, 53% of large employers predicted that they will increase investment in virtual care in 2021. Mental health is also a significant focus, with 88% of large employers planning to offer mental health support services this year.

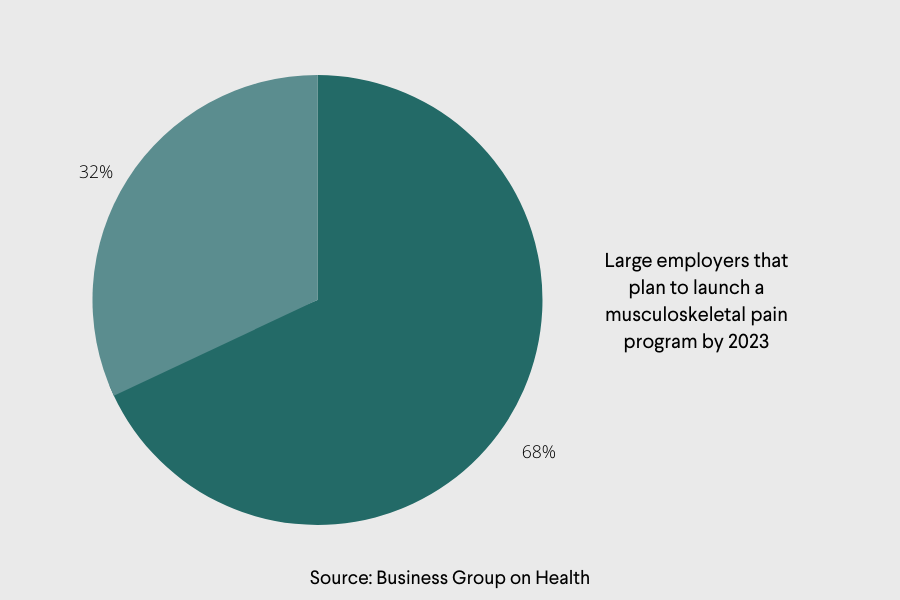

More employers are also planning to address health conditions that have long been a source of high costs, such as musculoskeletal pain. Ninety percent of respondents cited musculoskeletal pain as a top healthcare cost, up from 85% the prior year. In Business Group on Health’s report on 2021 benefits strategies, 68% of employers said they predict they will have a corporate musculoskeletal program in place by 2023 in response to high costs.

Step 3: Conduct a wellness survey.

One way to get a sense of the benefits offerings your employees would use – or that could potentially improve health outcomes – is to conduct a wellness survey.

When sharing out your survey, it’s important to communicate that responses will be anonymous, and to keep questions relatively general. For example, you could ask employees whether they or someone else on their healthcare plan would be interested in a list of programs, if offered, and ask them to check off the ones they are interested in.

You can also ask them to rank their interest so you can isolate programs your teams may be the most engaged with. Looking for inspiration? WELCOA has a free template that HR leaders can use to survey employees about their wellness interests and needs.

You don’t have to limit the concept of “wellness” to physical health, either. Include programs that support mental health, or even financial wellness. A successful long-term benefits strategy takes into account how your company can support employees as complete people, across a spectrum of needs.

Step 4: Identify gaps in your employee benefits strategy.

Once you’ve analyzed what your competitors are up to and researched benefits trends on the horizon, the next step in the benefits planning process is to conduct a gap analysis. Where is your benefits strategy falling short?

This step can also include an audit of your existing benefits offerings. Are there any voluntary benefits that your staff isn’t using? Are there any ways you can boost engagement around those existing programs? For example, a wellness champion network can help you identify evangelists among your employees and support your efforts. A strategic employee benefits communications plan can also jumpstart engagement with existing programs.

You should come out of this exercise with a list of new benefits programs you’re considering.

Step 5: Determine success metrics.

Once you have your list of potential benefits offerings, consider what success would look like for each program. Do you want to help employees quit smoking? Relieve chronic pain? Lose weight? Chances are, the vendors you choose will be able to help you set starting benchmarks, but as you figure out whether there’s a business case for your program, it makes sense to find those numbers yourself first.

For a health program, get a sense of the top cost drivers of your existing plans. You can also consider the costs of absenteeism and presenteeism associated with the healthcare problems you’re looking to tackle, and factor those numbers into your costs.

From there, consider the savings, compared with the cost of a vendor, if you reduce or increase your key numbers by a certain percentage. Having a rough estimate of these numbers ahead of time can help you have better-informed conversations with vendors when you reach that stage.

Step 6: Start conversations with vendors.

If you take the time to understand your company’s needs and your goals for the program in advance, you’ll be ready to have thoughtful and productive conversations with vendors you’re considering.

Questions to ask potential vendors in early conversations may include:

- Can spouses and domestic partners on our employee plan use the program?

- What results can we expect from the program?

- How do you engage employees in the program?

- What materials can you provide to support our program launch?

Look for companies that align with the goals you set out, and that have a solid plan for how they’ll launch and engage employees.

Step 7: Consider timing.

If you’ve landed on additional benefits to start offering your teams, be sure to consider timing. While some benefits are best rolled out during open enrollment, others may make more sense “off cycle.” Employees may want additional time to research a new worker benefit, or there may simply not be a compelling reason to wait.

Look for companies that align with the goals you set out, and that have a solid plan for how they’ll launch and engage employees.

Thinking about a musculoskeletal (MSK) solution as part of your benefits offerings? Get in touch with Fern Health using the form below to learn how our digitally-delivered, multimodal program can reduce your healthcare costs while preventing unnecessary surgeries.